What is a Form 15g?

Banks deduct Tax Deducted at Source (TDS) when a taxpayer’s interest income drops below the basic exemption limit. However, if your total income is less than the taxable limit, you can easily submit Form 15G to the bank, appealing that no TDS should be withheld from the interest earned during the fiscal year. Interest income is the money received by putting a significant amount in any of your savings.

You can easily download a fillable form 15g in PDF format from CocoDoc and edit it accordingly. You should always provide your PAN and submit the complete form each year. To avoid bank deductions, we recommend that you complete Form 15G at the start of the financial year.

Components of 15g Form

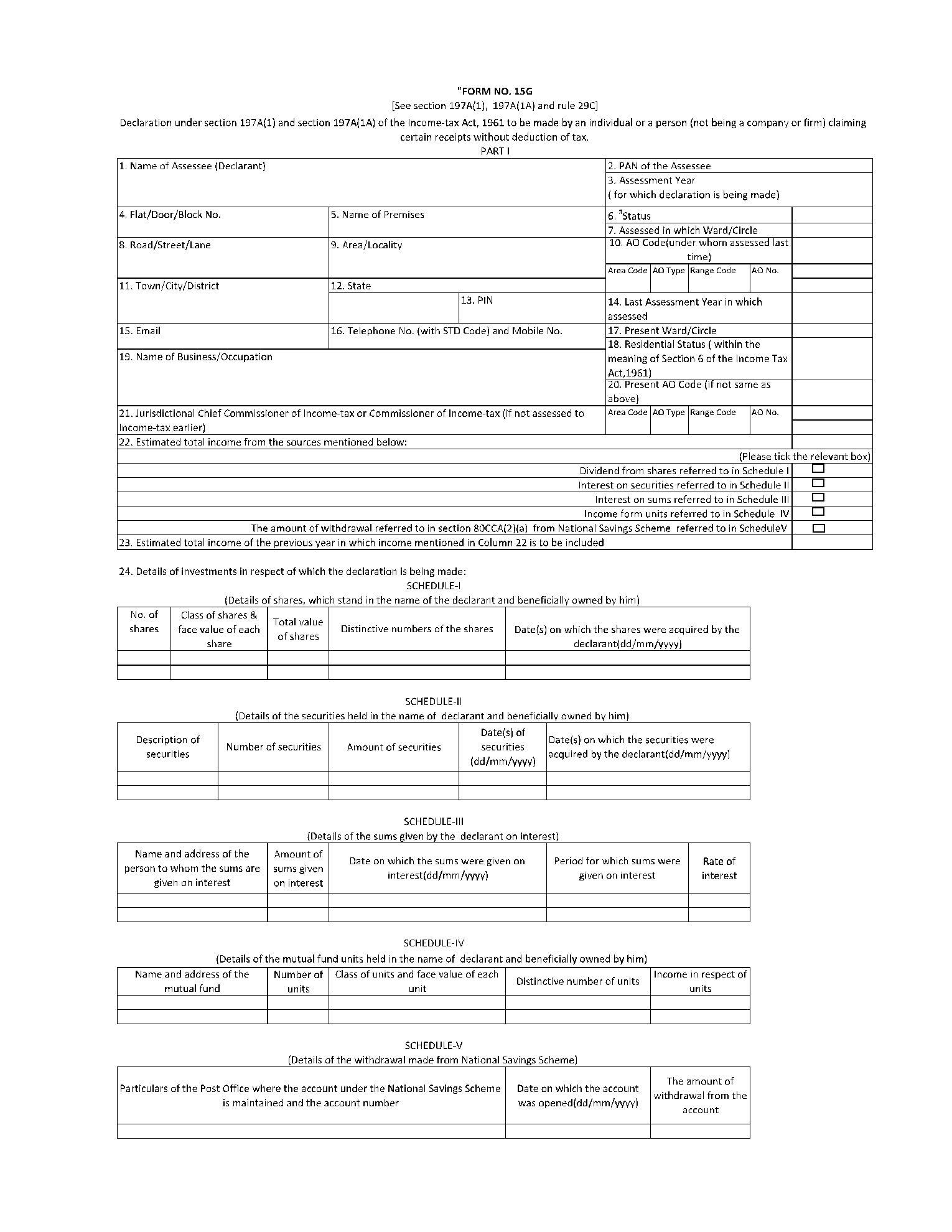

Form 15G is a two-page application form that consists of Parts I and II.

Part I consists of the following information:

- Your name and your PAN number.

- The financial year details

- Address and contact information

- Income specifics, such as the nature of the income and the clause under which it is deductible.

- A declaratory statement stating that the information provided is correct and not deceptive.

Part II includes the following:

- Name of the person who collects taxes.

- PAN and TAN specifics

- Aadhaar card number

- Address and contact information

- Amount of money earned.

Form 15g Filling Instructions

There are 19 fields to be filled in the Form. Follow the instructions to learn how to fill the 15G form.

Part I

This section must be filled by the person (individual) who wants to claim certain ‘incomes’ without TDS.

(1) Name of the Assessee (Declarant) – Enter your name as mentioned on your PAN Card.

(2) PAN of the Assessee: Add your valid PAN number.

(3) Status: Identify your taxpayer status as an individual or HUF, whatever applies to you.

(4) Previous Year: Input the previous year as the fiscal year for which you are requesting the non-deduction of TDS.

(5) Residential Status: Check your residential status here. Non-residential are not eligible to submit Form 15g.

(6-14) Address Details: Fill in your address details correctly, including the PIN code, state, city, email ID, and phone number for further communication.

15 (a) Whether taxed under the Income-tax Act of 1961: If you were assessed to tax under the terms of the Income Tax Act of 1961 for any of the prior assessment years, mark "Yes."

(a) If yes, state the most recent assessment year for which you were assessed: Indicate the year in which your income exceeded the taxable limit.

(16) Estimated earnings for which this declaration is being made: Fill in the amount of interest or other income that should not be taxed.

(17) P.Y.'s estimated total income: Calculate your entire income from all sources, including your pay, stipend, interest income, and any other money earned throughout the year. Include the earnings indicated in field 16.

(18) Additional information, if any, other than Form 15G: If you have previously completed Form 15G, indicate the total number of forms completed as well as the total amount of income.

(19) Details of income for which the declaration is filed: The final component of section 1 requires you to fill in the nature and amount of income for which you are submitting the declaration. You should provide the investment account number ( employee identification, term deposit, fixed deposit account number, life insurance policy number/, etc.).

Signatures: Embed your signature on form 15G. Remember that your signature must match the signature on your income tax return. Please include your capacity if you are submitting the form as the authorized signatory of a HUF or AOP.

Part II

This section must be completed by the person or institution in charge of paying the revenue. A bank, for example, may pay 'interest income' on a depositor's fixed deposit.

Once done filling out all fields, double-check everything to ensure there are no mistakes. Remember that making false claims and providing misleading information is illegal and can result in fines and even imprisonment.

What is the Purpose of Form 15g?

Form 15G ensures that eligible individuals don't pay deductions or TDS on interest income. The following situations highlight how taxpayers may use Form 15G to reduce the TDS burden:

TDS on rental income: If the rent on the property exceeds Rs 2.4 per year, the renter will deduct TDS. If your total taxable due is zero, you must file Form 15G or Form 15H.

TDS on fixed deposits interest: You need to submit form 15G to banks and financial institutions to avoid any deduction on TDS.

Insurance commission taxed at the source: If the insurance commission exceeds Rs 15000 in a fiscal year, tax is deducted. If the total taxable due is zero, an insurance agent can file Form 15G or Form 15H.

TDS on post office deposits: Form 15G is also accepted by post offices. You must submit to verify that there are no TDS deductions on your income.

TDS on corporate bond income: TDS is applicable if your total income from corporate bonds exceeds Rs 5000. You can use Form 15G or Form 15H to request that the financial institution deduct TDS from your interest income.

On top of bank fixed deposits, you can use Form 15G to avoid paying TDS on withdrawals from Employees Provident Fund (EPF), corporate bonds, post office deposits, and even rental income.

Who Is Eligible for Form 15g?

The following conditions must be met to submit Form 15G as a self-declaration successfully:

- Form 15G is for all taxpayers (excluding companies and partnership firms).

- Form 15G is applicable only for ‘residents’.

- You must be below 60 years of age.

- You have zero tax liability. Your income tax calculated should be below the taxable limit.

- The total interest income for the year is less than the basic exemption limit of that year.

- The assessee must file these forms at the beginning of the financial year.

Form 15g External Resources

For more information about the 15G Form, check out our websites and other external resources, including:

- https://groww.in/p/savings-schemes/form-15g/

- https://www.relakhs.com/how-to-fill-new-form-15g-form-15h-tds/

- https://www.moneymanch.com/how-to-fill-form-15g/

Use CocoDoc to download Form 15G, fill the Part 1 section, and convert it into PDF. Easily embed your signature electronically, save and upload the PDF copy to make an online claim.